UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to |

Build-A-Bear Workshop, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) | Title of each class of securities to which transaction applies: | |

|

| |

(2) | Aggregate number of securities to which transaction applies: | |

|

| |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

| |

(4) | Proposed maximum aggregate value of transaction: | |

|

| |

(5) | Total fee paid: | |

|

|

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: | |

|

| |

(2) | Form, Schedule or Registration Statement No.: | |

|

| |

(3) | Filing Party: | |

|

| |

(4) | Date Filed: | |

|

|

Build-A-Bear Workshop, Inc.

1954 Innerbelt Business Center Drive

St. Louis, Missouri 63114

March 31, 2017April 19, 2019

Dear Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Build-A-Bear Workshop, Inc. to be held at our World Bearquarters, 1954 Innerbelt Business Center Drive, St. Louis, Missouri 63114 on Thursday, May 11, 2017,June 6, 2019, at 10:00 a.m. Central Time. For your reference, directions for our annual meeting site are provided at Appendix BA to this proxy statement.

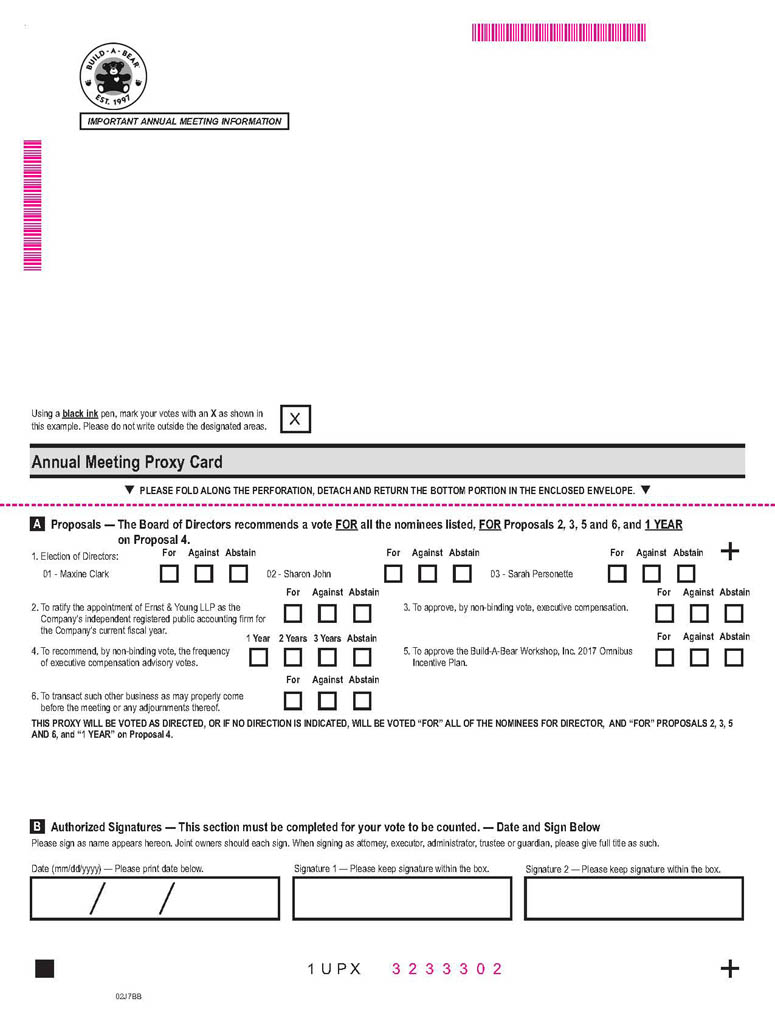

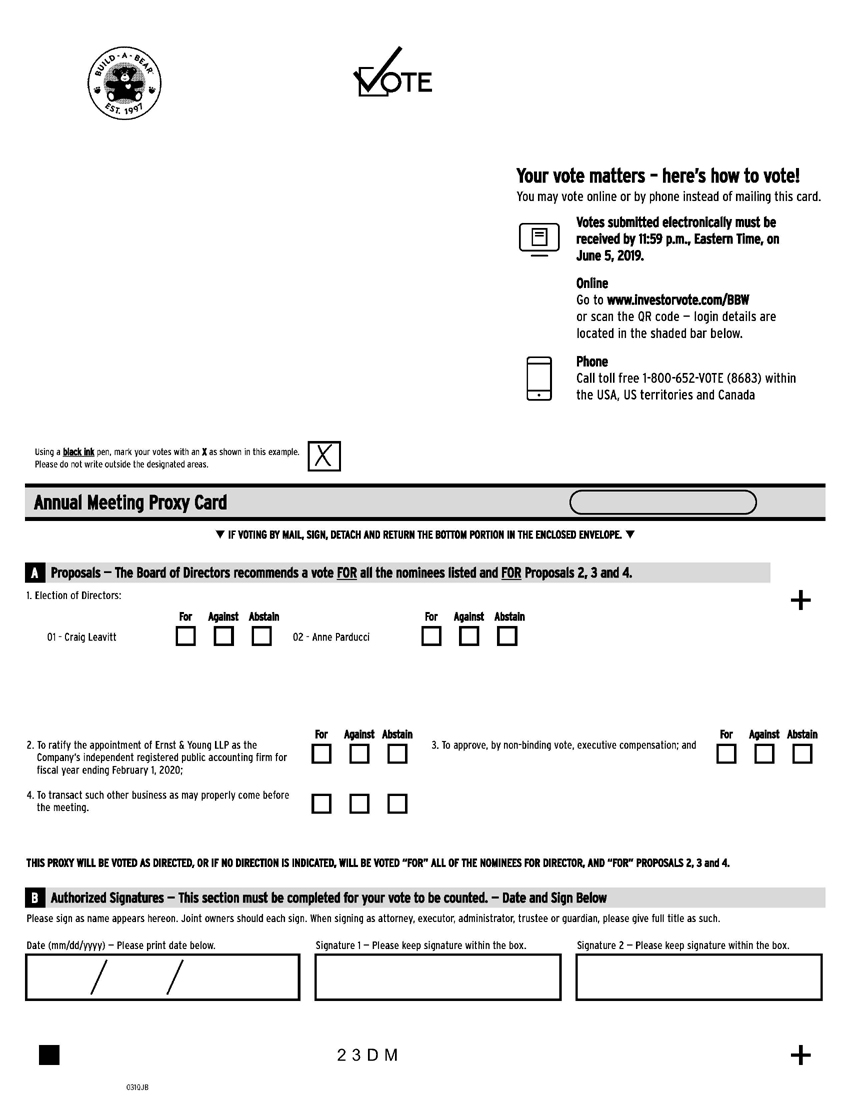

At the meeting, you will be askedasked to elect threetwo Directors; ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our current fiscal year; approve, by non-binding vote, executive compensation; recommend, by non-binding vote, the frequency of executive compensation votes; approve our omnibus incentive plan; and transact such other business as may properly come before the meeting.

The formal Notice of Annual Meeting of Stockholders and proxy statement accompanying this letter provide detaileddetailed information concerning matters to be considered and acted upon at the meeting. Your vote is important. I urge you to vote as soon as possible, whether or not you plan to attend the annual meeting. You may vote via the Internet, as well as by telephone or by mailing the proxy card. Please review the instructions with the proxy card regarding each of these voting options.

Thank you for your continued support of, and interest in, Build-A-Bear Workshop. I look forward to seeing you at the annual meeting.

| Sincerely, |

|

|

|

|

| Sharon John |

| President and Chief Executive Officer |

Build-A-Bear Workshop, Inc.

1954 Innerbelt Business Center Drive

St. Louis, Missouri 63114

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 11June 6, 20179

The 20172019 Annual Meeting of Stockholders of BUILD-A-BEAR WORKSHOP, INC., a Delaware corporation (the “Company”), will be held at our World Bearquarters, 1954 Innerbelt Business Center Drive, St. Louis, Missouri 63114, on Thursday, May 11, 2017,June 6, 2019, at 10:00 a.m. Central Time, to consider and act upon the following matters:

1. to elect threetwo Directors;

2. to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the Company’s current fiscal year;2019;

3. to approve, by non-binding vote, executive compensation; and

4. to recommend, by non-binding vote, the frequency of executive compensation advisory votes;

5. to approve the Build-A-Bear Workshop, Inc. 2017 Omnibus Incentive Plan; and

6. to transact such other business as may properly come before the meeting or any adjournments thereof.

Only stockholders of record at the close of business on March 21, 2017April 17, 2019 are entitled to notice of and to vote at the annual meeting. At least ten days prior to the meeting, a complete list of stockholders entitled to vote will be available for inspection by any stockholder for any purpose germane to the meeting, during ordinary business hours, at the office of the Secretary of the Company at 1954 Innerbelt Business Center Drive, St. Louis, Missouri 63114. As a stockholder of record, you are cordially invited to attend the meeting in person. Regardless of whether you expect to be present at the meeting, please either (i) complete, sign and date the enclosed proxy and mail it promptly in the enclosed envelope, or (ii) vote electronically via the Internet or telephone as described in greater detail in the proxy statement. Returning the enclosed proxy, voting electronically, or voting telephonically will not affect your right to vote in person if you attend the meeting.

| By Order of the Board of Directors |

|

|

|

|

| Eric Fencl |

| Chief Administrative Officer, General Counsel and Secretary |

EVEN THOUGH YOU MAY PLAN TO ATTEND THE MEETING IN PERSON, PLEASE VOTE BY TELEPHONE OR THE INTERNET, OR EXECUTE THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY. A RETURN ENVELOPE (WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR YOUR CONVENIENCE. TELEPHONE AND INTERNET VOTING INFORMATION IS PROVIDED ON YOUR PROXY CARD. SHOULD YOU ATTEND THE MEETING IN PERSON, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERSTOCKHOLDER MEETING TO BE HELD ON MAY 11JUNE 6, 20179

The Company’sCompany’s proxy statement and Annual Report on Form 10-K for the 20162018 fiscal year and summary Annual Report to Stockholders are available at https://materials.proxyvote.com/120076.

TABLE OF CONTENTS |

| Page |

Proxy Statement | 1 |

About the Meeting | 1 |

Voting Securities |

|

Security Ownership of Certain Beneficial Owners and Management | 4 |

Proposal No. 1. Election of Directors | 5 |

Directors |

|

The Board of Directors and its Committees |

|

Committee Charters, Corporate Governance Guidelines, Business Conduct Policy and Code of Ethics |

|

Board Member Independence and Committee Member Qualifications |

|

Related Party Transactions |

|

Section 16(a) Beneficial Ownership Reporting Compliance |

|

Board of Directors Compensation |

|

Executive Compensation |

|

Executive Compensation |

|

|

|

|

|

|

|

|

|

Outstanding Equity Awards at |

|

|

|

|

|

Executive Employment and Severance Agreements |

|

Proposal No. 2. Ratification of Appointment of Independent Accountants |

|

Proposal No. 3. Advisory (Non-binding) Vote Approving Executive Compensation |

|

|

|

|

|

Report of the Audit Committee |

|

Stockholder Communications with the Board |

|

Selection of Nominees for the Board of Directors |

|

Stockholder Proposals |

|

Other Matters |

|

Appendix |

|

|

|

BUILD-A-BEAR WORKSHOP, INC.

1954 Innerbelt Business Center Drive

St. Louis, Missouri 63114

20179 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Build-A-Bear Workshop, Inc., a Delaware corporation (the “Company” or “Build-A-Bear Workshop”), to be voted at the 20172019 Annual Meeting of Stockholders of the Company and any adjournment or postponement of the meeting. The meeting will be held at our World Bearquarters, 1954 Innerbelt Business Center Drive, St. Louis, Missouri 63114, on Thursday, May 11, 2017,June 6, 2019, at 10:00 a.m. Central Time, for the purposes contained in the accompanying Notice of Annual Meeting of Stockholders and in this proxy statement. For your reference, directions to our annual meeting site are provided at Appendix BA to this proxy statement.

ABOUT THE MEETING

Why Did I Receive This Proxy Statement?

Because you were a stockholder of the Company as of March 21, 2017April 17, 2019 (the “Record Date”) and are entitled to vote at the annual meeting, the Board of Directors is soliciting your proxy to vote at the meeting.

This proxy statement summarizes the information you need to know to vote at the meeting. This proxy statementstatement and form of proxy were first mailed to stockholders on or about March 31, 2017.April 26, 2019.

What Am I Voting On?

You are voting on fivethree items:

(a) | the election of |

(b) | the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal |

(c) | the approval, by non-binding | |

|

| |

|

|

How Do I Vote?

Stockholders of Record: If you are a stockholder of record, there are four ways to vote:

(a) | by toll-free telephone at 1-800-652-8683; |

(b) | by Internet at www.investorvote.com/BBW; |

(c) | by completing and returning your proxy card in the postage-paid envelope provided; or |

(d) | by written ballot at the meeting. |

Street Name Holders: Shares which are held in a brokerage account in the name of the broker are said to be held in “street name.” If your shares are held in street name you should follow the voting instructions provided by your broker. You may complete and return a voting instruction card to your broker, or, in many cases, your broker may also allow you to vote via the telephone or Internet. Check your proxy card for more information. If you hold your shares in street name and wish to vote at the meeting, you must obtain a legal proxy from your broker and bring that proxy to the meeting.

Please note that brokers may no longer use discretionary authority to vote shares on the election of Directors or on executive compensation matters or on approval of equity compensation plans if they have not received instructions from their clients. Please vote your proxy so your vote can be counted.

Regardless of how your shares are registered, if you complete and properly sign the accompanying proxy card and return it to the address indicated,, it will be voted as you direct.

What is the Deadline for Voting via Internet or Telephone?

Internet and telephone voting for stockholders of record is available through 11:59 p.m. Eastern Time on Wednesday, May 10, 2017June 5, 2019 (the day before the annual meeting).

What Are the Voting Recommendations of the Board of Directors?

The Board recommends the following votes:

(a) | FOR the election of each of the |

(b) | FOR ratification of the appointment of Ernst & Young LLP as independent registered public accounting firm for fiscal |

(c) | FOR the non-binding | |

|

| |

|

|

Unless you give contrary instructions on your proxy card, the persons named as proxy holders will vote your shares in accordance with the recommendations of the Board of Directors.

Will Any Other Matters Be Voted On?

We do not know of any other matters that will be brought before the stockholders for a vote at the annual meeting. If any other matter is properly brought before the meeting, your signed proxy card gives authority to Sharon John,, Voin Todorovic and Eric Fencl to vote on such matters in their discretion.

Who Is Entitled to Vote at the Meeting?

Only stockholders of record at the close of business on the Record Date are entitled to receive notice of and to participate in the annual meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you heldheld on that date at the meeting, or any postponements or adjournments of the meeting.

How Many Votes Do I Have?

You will have one vote for every share of Build-A-Bear Workshop common stock you owned on the Record Date.

How Many Votes Can Be Cast by All Stockholders?

16,003,016,15,142,983, consisting of one vote for each share of Build-A-Bear Workshop common stock outstanding on the Record Date. There is no cumulative voting.

How Many Votes Must Be Present to Hold the Meeting?

The holders of a majority of the aggregate voting power of Build-A-Bear Workshop common stock outstanding on the Record Date, or 8,001,5097,571,492 votes, must be present in person, or by proxy, at the meeting in order to constitute a quorum necessary to conduct the meeting.

If you vote, your shares will be part of the quorum. Abstentions and broker non-votes will be counted in determining the quorum. A broker non-vote occurs when a bank or broker holding shares in street name submits a proxy that states that the brokerbroker does not vote for some or all of the proposals because the broker has not received instructions from the beneficial owners on how to vote on the proposals and does not have discretionary authority to vote in the absence of instructions.

We urge you to vote by proxy even if you plan to attend the meeting so that we will know as soon as possible that a quorum has been achieved.

What Vote Is Required to Approve Each Proposal?

In the election of Directors (Proposal 1), the affirmative vote of the majoritymajority of votes cast in person or by proxy with respect to a Director nominee’s election will be required for approval of each Director who is up for election, meaning the number of shares voted “for” a nominee must exceed the number of shares voted “against” such nominee. If any nominee for Director receives a greater number of votes “against” his or her election than votes “for” such election, our Director Resignation Policy requires that such person must promptly tender his or her resignation to the Board following certification of the vote. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the election of nominees.

For the proposals to (i) ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 20172019 (Proposal 2), and (ii) approve, by non-binding vote, executive compensation (Proposal 3), and (iii) approve the Build-A-Bear Workshop, Inc. 2017 Omnibus Incentive Plan (Proposal 5), the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the proposal will be required for approval, meaning that of the shares represented at the meeting and entitled to vote, a majority of them must be voted “for” the proposal for it to be approved. Abstentions will have the same effect as a vote “against” these proposals, and broker non-votes will have no effect on the vote for these proposals.

The frequency of the advisory vote on executive compensation (Proposal 4) receiving the greatest number of votes (every one, two or three years) will be considered the frequency recommended by stockholders. Abstentions and broker non-votes will therefore have no effect on such vote.

Please vote your proxyproxy so your vote can be counted. This is particularly important since brokers may no longernot use discretionary authority to vote shares onin the election of Directors or on executive compensation matters or on approval of equity compensation plans if they have not received instructions from their clients. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to the matter and will therefore have no effect on the outcome of that matter.

Can I Change My Vote?

Yes. To change your vote, send in a new proxy card with a later date, cast a new vote by telephone or Internet, or send a written notice of revocation bearing a date later than the date of the proxy to the Company’s Corporate Secretary at the address on the cover of this proxy statement. Also, if you attend the meeting and wish to vote in person, you may request that your previously submitted proxy not be used.

How Can I Access the Company’sCompany’s Proxy Materials and Annual Report Electronically Online?

This proxy statement and the 20162018 Annual Report on Form 10-K are available at https://materials.proxyvote.com/120076.

Who Can Attend the Annual Meeting?Meeting?

Any Build-A-Bear Workshop stockholder as of the Record Date may attend the meeting. If you own shares in street name, you should ask your broker or bank for a legal proxy to bring with you to the meeting. If you do not receive the legal proxy in time,time, bring your most recent brokerage statement so that we can verify your ownership of our stock and admit you to the meeting. However, you will not be able to vote your shares at the meeting without a legal proxy.

If you return a proxy card without indicating your vote, your shares will be voted as follows: (i) FOR the threetwo nominees for Director named in this proxy statement (Proposal 1); (ii) FOR ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm for the Company for fiscal 20172019 (Proposal 2); (iii) FOR approval, by non-binding resolution, of executive compensation (Proposal 3); (iv) ONE YEAR on the proposal recommending the frequency of advisory votes on executive compensation (Proposal 4); (v) FOR approval of the Build-A-Bear Workshop, Inc. 2017 Omnibus Incentive Plan (Proposal 5); and (vi)(iv) in accordance with the recommendation of management on any other matter that may properly be brought before the meeting and any adjournment of the meeting.

Proof of ownership of Build-A-Bear Workshop stock, as well as a valid form of personal identification (with picture), must be presented in order to attend the annual meeting.

What is “Householding”“Householding” of Proxy Materials?

The Securities and Exchange Commission (“SEC”) has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company and some brokers household proxy materials, delivering a single proxy statement to multiple stockholders sharing an address unless contrary instructions have been received from one or more of the affected stockholders. The Company will deliver, promptly upon request, a separate copy of the proxy statement to any stockholder who is subject to householding. You can request a separate proxy statement by writing to the Company at Build-A-Bear Workshop, Inc., Attention: Corporate Secretary, 1954 Innerbelt Business Center Drive, St. Louis, Missouri 63114 or by calling the Company at (314) 423-8000. Once you have received notice from your broker or the Company that they are or we will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement in the future, or if you currently receive multiple proxy statements and would prefer to participate in householding, please notify your broker if your shares are held in a brokerage account or the Company if you hold registered shares. You can notify the Company by sending a written request to Build-A-Bear Workshop, Inc., Attention: Corporate Secretary, 1954 Innerbelt Business Center Drive, St. Louis, Missouri 63114 or by calling the Company at (314) 423-8000.as noted above.

Who Pays for the Solicitation of Proxies?

The Company will bear the cost of the solicitation of proxies for the meeting. BrokerageBrokerage houses, banks, custodians, nominees and fiduciaries are being requested to forward the proxy material to beneficial owners and their reasonable expenses therefor will be reimbursed by the Company. Solicitation will be made by mail and also may be made personally or by telephone, facsimile or other means by the Company’s officers, Directors and employees, without special compensation for such activities.

VOTING SECURITIES

On the Record Date, there were 16,003,016 15,142,983 outstanding shares of the Company’s common stock (referred to herein as “shares”).

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the beneficial ownership of the Company’sCompany’s shares as of March 21, 2017April 17, 2019 (unless otherwise noted) by (i) each person known by the Company to own beneficially more than 5% of the outstanding shares, (ii) each Director and Director nominee of the Company, (iii) each executive officer of the Company named in the Summary Compensation Table (the “Named Executive Officers” or “NEOs”), and (iv) all executive officers and Directors of the Company as a group. The table includes shares that may be acquired within 60 days of March 21, 2017April 17, 2019 upon the exercise of stock options by employees or outside Directors and shares of restricted stock. Unless otherwise indicated, each of the persons or entities listed below exercises sole voting and dispositive power over the shares that each of them beneficially owns. Except as indicated below, the address of each person or entity listed is c/o Build-A-Bear Workshop, Inc., 1954 Innerbelt Business Center Drive, St. Louis, Missouri 63114. For the beneficial ownership of the stockholders owning 5% or more of the shares, the Company relied on publicly available filings and representations of the stockholdersstockholders.

Name of Beneficial Owner |

| Amount and Nature of Shares of Common Stock Beneficially Owned(18)(19) |

|

| Percentage of Class |

| ||

Point72 Asset Management, L.P.(1) | 2,341,479 | 14.6 | % | |||||

Braden Leonard(2) |

|

| 1,600,043 |

|

|

| 10.0 | % |

Dimensional Fund Advisors LP(3) |

|

| 1,331,738 |

|

|

| 8.3 | % |

Nokomis Capital, L.L.C. (4) | 1,084,393 | 6.8 | % | |||||

BlackRock, Inc. (5) | 866,966 | 5.4 | % | |||||

Cannell Capital LLC(6) | 793,261 | 5.0 | % | |||||

Sharon John(7) |

|

| 451,556 |

|

|

| 2.8 | % |

Eric Fencl(8) |

|

| 204,346 |

|

|

| 1.3 | % |

Maxine Clark(9) |

|

| 187,433 |

|

|

| 1.2 | % |

Mary Lou Fiala(10) |

|

| 127,333 |

|

|

| * |

|

Coleman Peterson(11) |

|

| 107,872 |

|

|

| * |

|

Jennifer Kretchmar(12) |

|

| 53,070 |

|

|

| * |

|

Voin Todorovic (13) |

|

| 49,558 |

|

|

| * |

|

J. Christopher Hurt (14) |

|

| 40,247 |

|

|

| * |

|

Michael Shaffer(15) |

|

| 15,747 |

|

|

| * |

|

Timothy Kilpin (16) |

|

| 7,068 |

|

|

| * |

|

Sarah Personette (16) |

|

| 7,068 |

|

|

| * |

|

All Directors and executive officers as a group (12 persons)(17) |

|

| 2,851,341 |

|

|

| 17.5 | % |

Name of Beneficial Owner | Amount and Nature of Shares of Common Stock Beneficially Owned(17)(18) |

Percentage of Class | |||||||

David L. Kanen(1) | 1,456,735 | 9.6 | % | ||||||

Dimensional Fund Advisors LP(2) | 1,316,444 | 8.7 | % | ||||||

Point72 Asset Management, L.P.(3) | 933,825 | 6.2 | % | ||||||

Renaissance Technologies LLC(4) | 864,100 | 5.7 | % | ||||||

J. Carlo Cannell(5) | 846,453 | 5.6 | % | ||||||

Pacifica Capital Investments(6) | 834,530 | 5.5 | % | ||||||

Sharon John(7) | 711,407 | 4.6 | % | ||||||

Maxine Clark(8) | 120,486 | * | |||||||

Jennifer Kretchmar(9) | 112,190 | * | |||||||

J. Christopher Hurt (10) | 89,811 | * | |||||||

Michael Shaffer(11) | 33,017 | * | |||||||

Sarah Personette (12) | 24,338 | * | |||||||

Anne Parducci (13) | 15,711 | * | |||||||

Craig Leavitt (14) | 15,108 | * | |||||||

Robert Dixon (15) | 12,103 | * | |||||||

All Directors and executive officers as a group (11 persons)(16) | 1,472,680 | 9.4 | % | ||||||

* | Less than 1.0%. |

| Represents |

(2) | Represents 1,316,444 shares held by funds to which Dimensional Fund Advisors LP (“Dimensional”) serves as investment advisor. Dimensional has sole dispositive power over the shares reported and sole voting power over 1,252,362 shares. The principal address of Dimensional is Building One, 6300 Bee Cave Road, Austin, Texas 78746. All information regarding ownership by Dimensional is based solely on a Schedule 13G/A filed by Dimensional on February 8, 2019. Dimensional disclaims beneficial ownership of any such shares. |

(3) | Represents 933,825 shares beneficially owned by Point72 Asset Management, L.P. (“Point72 Asset Management”), Point72 Capital Advisors, Inc. (“Point72 Capital Advisors”) and Steven A. Cohen with respect to which they share voting and dispositive power. Point72 Asset Management, Point72 Capital Advisors, and Mr. Cohen own directly no shares. |

|

|

|

|

|

|

|

|

| Represents an aggregate of |

| Represents |

(7) | Represents 167,318 shares of common stock, |

|

|

| Represents |

| Represents |

|

|

|

|

| Represents |

| Represents |

|

|

| Represents |

| Represents 5,918 shares of common stock and 9,793 restricted shares. |

(14) | Represents 3,479 shares of common stock and 11,629 restricted shares. |

(15) | Represents 2,310 shares of common stock and 9,793 restricted shares. |

(16) | Includes |

| No Director or Named Executive Officer beneficially owns shares that are pledged as security. |

| Share numbers include restricted stock granted to Named Executive Officers on |

PROPOSAL NO. 1. ELECTION OF DIRECTORS

The Company'sCompany's Board of Directors presently has eightseven members, divided into three classes which as nearly as possible are equal in number. The classes have staggered three-year terms. As a result, only one class of Directors is elected at each annual meeting of our stockholders. Craig Leavitt and Anne Parducci are Class III Directors, and their terms will expire at the 2019 annual meeting. Maxine Clark, Sharon John, and Sarah Personette are Class I Directors, and their terms will expire at the 20172020 annual meeting. Braden Leonard, Coleman PetersonRobert L. Dixon, Jr. and Michael Shaffer are Class II Directors, and their terms will expire at the 2018 annual meeting. Mary Lou Fiala, and Timothy Kilpin are Class III Directors, and their terms will expire at the 20192021 annual meeting. Currently, all of our Directors hold office until the annual meeting of stockholders at which their terms expire or until their successors are duly elected and qualified.

Under our Corporate Governance Guidelines, a Director may not stand for election or re-election after reaching the age of 73. Barney Ebsworth did not stand for re-election at the 2006 annual meeting and serves the Company as Director Emeritus.

A Director Emeritus is not permitted to vote on matters brought before the Board of Directors or any Board committee and is not counted for the purposes of determining whether a quorum of the Board or a Board committee is present. A Director Emeritus is not compensated for his or her services.

The Nominating and Corporate Governance CommitteeCommittee nominated the Class IIII Directors, Mses. Clark, JohnMr. Leavitt and Personette,Ms. Parducci, to be re-elected to serve until the 20202022 annual meeting of stockholders or until their successors are duly elected and qualified. As noted below, Mses. Clark and John have served onMs. Parducci was referred to us by a former member of our Board of Directors for several years. Ms. Personette was recommended to us by a third-party and was appointed to the Board of Directors in February 2016.September 2017. Mr. Leavitt was recommended to us by an executive search consulting firm and was appointed to the Board of Directors in January 2018.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”“FOR” THE NAMED NOMINEES

Proxies cannot be voted for a greater number of persons than the number of nominees named herein.herein. Unless otherwise specified, all proxies will be voted in favor of the threetwo nominees listed herein for election as Directors.

The Board has no reason to expect that any of the nominees will be unable to stand for election on the date of the meeting or forfor good cause will not serve. If a vacancy occurs among the original nominees prior to the meeting, the proxies will be voted for a substitute nominee named by the Board of Directors and for the remaining nominees. Directors are elected by the affirmative vote of the majority of votes cast in person or by proxy with respect to a Director nominee’s election, provided, however, that, in accordance with the Company’s Bylaws,amended and restated bylaws, if the number of nominees exceeds the number of Directors to be elected at the meeting, then Directors shall be elected by the affirmative vote of a plurality of the votes present in person or by proxy and entitled to vote at the meeting.

DIRECTORS

Set forth below are the names, ages, positions and brief accounts of the business experience for each of our Directors as of March 21, 2017.April 17, 2019. The biographies of each of the nominees and continuing Directors below contains information each Director has given us about his or her age, all positions he or she holds, his or her principal occupation and business experience for the past five years, and the names of other publicly held companies of which he or she currently serves as a Director or has served as a Director during the past five years. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a Director, we also believe that all of our Director nominees and continuing Directors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to the Company and our Board.

Class | |

| Craig Leavitt, 58, was appointed to the Board of Directors on January 4, 2018 and serves as our Non-Executive Chairman. He served as Chief Executive Officer and Director of Kate Spade & Company, a formerly publicly traded operator of global, multichannel lifestyle brands, from February 2014 until August 2017 when the company was acquired by Coach, Inc. From October 2010 until February 2014, he was Chief Executive Officer of Kate Spade New York, a division of Fifth & Pacific Companies, Inc. Mr. Leavitt also served as Co-President and Chief Operating Officer of Kate Spade, LLC from April 2008 through October 2010. Prior to joining Kate Spade, LLC, Mr. Leavitt was President of Global Retail at Link Theory Holdings, where he had total responsibility for merchandising, operations, planning, allocation and real estate for the Theory and Helmut Lang retail businesses. Previously, Mr. Leavitt spent several years at Diesel, S.p.A., an Italian retail clothing company, having most recently served as Executive Vice President of Sales and Retail. Mr. Leavitt also spent 16 years at Polo Ralph Lauren, where he held positions of increasing responsibility, the last being Executive Vice President of Retail Concepts. Mr. Leavitt serves on the Board of Directors of Gildan Activewear, Inc., a publicly traded manufacturer of apparel. Mr. Leavitt serves on the Board of Directors of Euromarket Designs, Inc., doing business as Crate and Barrel, a company that owns and operates housewares, furniture and home accessories stores in North America and through franchisees internationally and HDS Global, a grocery and general merchandise delivery service. He also serves on the Board of Directors of The Roundabout Theater Company, a nonprofit theatre company. Mr. Leavitt holds a Bachelor of Arts from Franklin & Marshall College. Mr. Leavitt resides in New York. During his career in the retail industry, Mr. Leavitt has gained extensive experience in the areas of strategic planning, product development and innovation, marketing, store operations, and real estate. His background, including his service as Chief Executive Officer and Director of a publicly traded company, allows him to provide to our Board of Directors insights and perspectives regarding strategic planning, leadership, stockholder relations, business operations, brand management, marketing, and business development. |

| Anne Parducci, 57, was appointed to the Board of Directors on September 12, 2017. Since 2016, Ms. Parducci is the Principal and Founder of CaribouKids, LLC, an independent production company focused on acquisitions and content development of family targeted brands across direct-to-video, broadcast, streaming and social platforms. Prior to founding CaribouKids, Ms. Parducci served from 2004 to 2016 as Executive Vice President, Marketing of Lions Gate Entertainment Corporation, a publicly traded entertainment and media company, where she led brand management, consumer marketing, creative services, public relations and licensing across digital and physical home media distribution platforms. From 1989 to 2003, Ms. Parducci held several positions of increased responsibility at Mattel, Inc., including Senior Vice President, Business Development from 2002 to 2003, Senior Vice President of Worldwide Marketing, Girls Division from 2000 to 2002, and Senior Vice President of Marketing, Barbie from 1998 to 2000. She holds a Bachelor of Business Administration from University of Miami and a Master of Business Administration from University of Southern California, Marshall School of Management. Ms. Parducci resides in California with her husband and three children. Throughout her career, Ms. Parducci has gained extensive experience in business operations, content development, marketing and business development in the entertainment and toy industries. Her leadership roles, including those in the entertainment and toy industries, allow her to provide to our Board of Directors insights and perspectives regarding business operations, brand management, licensing, marketing, business development and public relations. |

| Class I Directors — Terms Expiring in 2020 | |

| Maxine Clark, Ms. Clark has extensive leadership and executive experience in the retail industry, which includes founding and |

| Sharon In her various executive management positions, Ms. John gained extensive experience in all aspects of retail branding, including children's brands, marketing to moms and kids, and licensing, product development and innovation expertise. With this background, Ms. John provides Build-A-Bear Workshop with highly relevant and valuable insights and perspectives in leading businesses, strategic planning, brand building, marketing, licensing, merchandising, and retail operations. |

| Sarah Personette, Ms. Personette has extensive sales and marketing experience, |

Class II Directors — Terms Expiring in 2021 | |

| Robert L. Dixon, Jr., 63,was appointed to our Board of Directors on February 12, 2018. Mr. Dixon has been the owner of The RD Factor, Inc., a digital and information technology consulting business, since December 2016. Mr. Dixon served as Global Chief Information Officer and Senior Vice President of PepsiCo, Inc. (“PepsiCo”), a publicly traded global food and beverage company, from November 2007 until April 2016 and as Senior Vice President until December 2016. Prior to joining PepsiCo, Mr. Dixon held various positions with The Procter & Gamble Company, a publicly traded consumer household products company, since 1977, including Vice President of Global Business Services from 2005 until 2007. Mr. Dixon serves on the Board of Directors of Anthem, Inc., a publicly traded health benefits company, the Georgia Institute of Technology College of Engineering Advisory Board, and the President’s Advisory Board of the Georgia Institute of Technology. He previously served on the CIO Advisory Board for International Business Machines Corporation. Mr. Dixon holds a Bachelor of Science Degree in Electrical Engineering from The Georgia Institute of Technology. He and his wife reside in McKinney, Texas. As Global Chief Information Officer of a large public company and through his service on the CIO advisory board for another large public company, Mr. Dixon has extensive technology experience. He also has significant marketing experiences through his senior positions at two large public companies, both of which have global retail consumer product focus. As a member of the Board of Directors of another publicly traded company, he has gained highly relevant corporate governance experience. |

| |

|

|

|

|

| Michael Shaffer, Throughout his career, Mr. Shaffer has obtained extensive financial and |

| |

|

|

|

|

| |

|

|

THE BOARD OF DIRECTORS AND ITS COMMITTEES

The Company’sCompany’s Board of Directors is responsible for establishing broad corporate policies and for overseeing the overall management of the Company. In addition to considering various matters which require Board approval, the Board provides advice and counsel to, and ultimately monitors the performance of, the Company’s senior management. There are three standing committees of the Board of Directors: the Audit Committee, the Compensation and Development Committee, and the Nominating and Corporate Governance Committee.

COMMITTEE CHARTERS, CORPORATE GOVERNANCE GUIDELINES, BUSINESS CONDUCT POLICY AND CODE OF ETHICS

The Board of Directors has adopted charters for all three of its standing Committees. The Board has also adopted Corporate Governance Guidelines,Guidelines, which set forth the obligations and responsibilities of the Directors with respect to independence, meeting attendance, compensation, re-election, orientation, self-evaluation, and stock ownership. The Board of Directors has also adopted a Business Conduct Policy which applies to all of the Company’s Directors and employees, and a Code of Ethics Applicable to Senior Executives, which applies to the Company’s senior executives, including the principal executive and financial officers, and the controller. Copies of the Committee charters, Corporate Governance Guidelines, Business Conduct Policy and Code of Ethics Applicable to Senior Executives can be found in the Corporate Governance section on the Company’s Investor Relations website at http://ir.buildabear.com (information on our website does not constitute part of this proxy statement). The Company intends to comply with the amendment and waiver disclosure requirements of applicable Form 8-K rules by posting such information on its website. The Company will post any amendments to the Committee charters, Corporate Governance Guidelines, Business Conduct Policy and Code of Ethics Applicable to Senior Executives in the same section of the Company’s website and these documents are also available in print to stockholders and interested parties upon written request delivered to Build-A-Bear Workshop, Inc., 1954 Innerbelt Business Center Drive, St. Louis, Missouri 63114. Each of our Directors, executive officers, Bearquarters associates, and store management signs our Business Conduct Policy on an annual basis to ensure compliance. In addition, each of our executives signs our Code of Ethics Applicable to Senior Executives each year to ensure compliance.

Board Leadership Structure

The Board has separated the role of Chairman from the role of Chief Executive Officer in recognition of the current demands of the two roles. While the Non-Executive Chairman organizes Board activities to enable the Board to effectively provide guidance to and oversight and accountability of management, the Chief Executive Officer is responsible for setting the strategic direction for the Company and the day to day leadership and performance of the Company. The Non-Executive Chairman creates and maintains an effective working relationship with the Chief Executive Officer and other members of management and with the other members of the Board; provides the Chief Executive Officer ongoing direction as to Board needs, interests and opinions; and assures that the Board agenda is appropriately directed to the matters of greatest importance to the Company. In carrying out herhis responsibilities, the Non-Executive Chairman preserves the distinction between management and Board oversight by (i) ensuring that management develop corporate strategy and risk management practices, and (ii) focusing the Board to review and express its judgments on such developments.

The Board believes this structure provides an efficient and effective leadership model for the Company. To assure effective independent oversight, the Board has adopted a number of governance practices, including:

A strong, independent, clearly-defined Non-Executive Chairman role;

Executive sessions of the independent Directors before or after every regular Board meeting; and

• | A strong, independent, clearly-defined Non-Executive Chairman role; | |

• | Executive sessions of the independent Directors before or after every regular Board meeting; and |

Annual performance evaluations of the Chief Executive Officer by the independent Directors.

The responsibilities of the Non-Executive Chairman include: (i) collaborating with the Board and the Chief Executive Officer to determine Board meeting agendas; (ii) presiding at all meetings of the Board, including executive sessions of the independent Directors; (iii) facilitating communication with independent Directors, including strategy updates; (iv) serving as principal liaison between the independent Directors, the Chief Executive Officer, and the Company’s management; (v) collaborating with the Board on Chief Executive Officer succession planning; (vi) collaborating with the Board regarding the retention of outside advisors and consultants who report directly to the Board when necessary; and (vii) if requested by stockholders, ensuring that he or she is available, when appropriate, for consultation and direct communication. The Non-Executive Chairman collaborates with the Board and the Chief Executive Officer to set strategic goals for the Company and develop plans to implement those goals.

Stockholders or interestedinterested parties can contact the Non-Executive Chairman, Mary Lou Fiala,Craig Leavitt, in writing c/o Build-A-Bear Workshop, Inc., 1954 Innerbelt Business Center Drive, St. Louis, Missouri 63114.

Meeting Attendance

The Board of Directors met teneight times in 20162018 for regular and special meetings. All Directors attended at least 75% of the aggregate number of meetings of the Board and committees on which they served. Overall attendance at meetings of the Board and Board committees in 20162018 by current Directors was approximately 92%98%. While the Company does not have a formal policy requiring members of the Board to attend the annual meeting, the Company encourages all Directors to attend. All of our current Directors attended our 20162018 annual meeting except for Ms. Personette who had a pre-existing conflict when she was appointed to our Board in February 2016. Alland all Directors plan to attend the 20172019 annual meeting.

The members, primary functions and number of meetings held for each of the Committees are described below.

Audit Committee

The members of the Audit Committee are Michael Shaffer (Chair), Mary Lou Fiala, Braden LeonardMaxine Clark, Robert Dixon and Timothy Kilpin.Craig Leavitt.

The Audit Committee reviews the independence, qualifications and performance of our independent auditors, and is responsible for recommendingrecommending the initial or continued retention of, or a change in, our independent auditors. The Committee reviews and discusses with our management and independent auditors our financial statements and our annual and quarterly reports, as well as the quality and effectiveness of our internal control procedures, critical accounting policies and significant regulatory or accounting initiatives.

The Committee discusses with management earnings press releases and our major financial risk exposures. Furthermore, the CommitteeCommittee is responsible for establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal control or auditing matters. The Committee approves the audit plan and staffing, duties and performance of the internal audit function. Periodically throughout each year, the Committee meets separately in executive session with management, the independent accountants, and the Company’s internal auditors to discuss any matters that the Committee or any of these groups believe should be discussed privately.

In fulfilling its responsibilities, the Committee reports regularly to the Board regarding its activities, reviews and reassesses the adequacy of its charter on an annual basis, and performs an annual self-evaluation of CommitteeCommittee performance. The Audit Committee held eightnine meetings in 2016.2018.

Compensation and Development Committee

The members of the Compensation and Development Committee are Coleman PetersonCraig Leavitt (Chair), Mary Lou Fiala, Timothy KilpinAnne Parducci, Sarah Personette and Sarah Personette.Michael Shaffer.

TheThe Compensation and Development Committee is responsible for evaluating and approving the Company’s overall compensation philosophy and policies and consults with management regarding the Company’s executive compensation program. The Committee makes recommendations to the Board of Directors regarding compensation arrangements for our executive officers, including annual salary, bonus and long-term incentive awards, and is responsible for reviewing and making recommendations to the Board regarding the compensation of the Company’s Directors. As part of its duties, the Committee oversees and administrates the Company’s employee benefit and incentive compensation plans and programs, including the establishment of certain applicable performance criteria and assessment of risks associated with those plans and programs. The Committee also reviews and assesses the adequacy of the Company’s stock ownership and retention guidelines for senior executives. For additional information on the Committee’s processes, please see the “Compensation Discussion and Analysis”“Executive Compensation” section of this proxy statement.

The Committee reports regularly to the Board regarding its activities, reviews and reassesses the adequacy of its charter on an annual basis and conducts an annual self-evaluation of Committee performance. The Compensation and Development Committee held fiveseven meetings in 2016.2018.

Nominating and Corporate Governance Committee

The members of the Nominating and Corporate Governance Committee are Braden LeonardMaxine Clark, Robert Dixon (Chair), Anne Parducci and Sarah Personette, Coleman Peterson, and Michael Shaffer.Personette.

The Nominating and Corporate GovernanceGovernance Committee establishes criteria for membership of the Company’s Board of Directors and its committees and selects and nominates candidates for election or re-election as Directors at the Company’s annual meeting. Additionally, the Committee determines the composition, nature and duties of the Board committees and oversees the Board and committee self-evaluation processes.

The Committee is also responsible for reviewing and making recommendations to the Board regarding the Company’sCompany’s Corporate Governance Guidelines, whistleblower policy and ethics codes.

The Committee reports regularly to the Board regarding its activities, reviews and reassesses the adequacy of its charter on an annual basis and conducts an annual self-evaluation of Committee performance.performance. The Nominating and Corporate Governance Committee held fivesix meetings in 2016.2018.

Risk Oversight by the Board

It is management’smanagement’s responsibility to assess and manage the various risks the Company faces. It is the Board’s responsibility to oversee management in this effort. In exercising its oversight, the Board has allocated some areas of focus to its committees and has retained areas of focus for itself, as more fully described below.

Management generally views the risks the Company faces as falling intointo the following categories: strategic, operational, financial, and compliance. The Board as a whole has oversight responsibility for the Company’s strategic and operational risks. Throughout the year, the Chief Executive Officer and other members of senior management discuss these risks with the Board during reviews that focus on a particular function.

The Audit Committee has oversight responsibility for financial risk (such as accounting, finance, internal controls and tax strategy). Oversight responsibilityresponsibility for compliance risk is shared among the Board committees. For example, the Audit Committee oversees compliance with finance and accounting laws and policies; the Compensation and Development Committee oversees compliance with the Company’s executive compensation plans and related laws and policies; and the Nominating and Corporate Governance Committee oversees compliance with governance-related laws and policies, including the Company’s Corporate Governance Guidelines.

Compensation Risk Assessment

During fiscal 2016, the Company undertook a comprehensive review of its material compensation plans and programs for all employees. In conducting this assessment, the Company inventoried its material plans and programs and presented a summary of its findings to the Compensation and Development Committee, which determined that none of its compensation plans and programs is reasonably likely to have a material adverse effect on the Company or promote undue risk taking.

BOARD MEMBER INDEPENDENCE AND COMMITTEE MEMBER QUALIFICATIONS

The Board of Directors annually determines the independence of Directors based upon a review conducted by the Nominating and Corporate Governance Committee and the Board of Directors. No DirectorDirector is considered independent unless he or she has no material relationship with the Company, either directly or as a partner, stockholder, family member, or officer of an organization that has a material relationship with the Company. All Directors identified as independent in this proxy statement meet the categorical standards adopted by the Board of Directors to assist it in making determinations of Director independence. On an annual basis, each Director and Named Executive Officer is obligated to complete a Director and Officer Questionnaire. Additionally, our Directors are expected to disclose any matters that may arise during the course of the year which have the potential to impair independence.

The Board has determined that, in its judgment as of the date of this proxy statement, each of the non-management Board members (including all members of the Audit, Nominating and Corporate Governance, and Compensation and Development Committees) are independent Directors, as defined by our Corporate Governance Guidelines and Section 303A of the New York Stock Exchange (“NYSE”) Listed Company Manual. Accordingly, Maxine Clark, Mary Lou Fiala, Timothy Kilpin, Braden Leonard,Robert Dixon, Craig Leavitt, Anne Parducci, Sarah Personette Coleman Peterson and Michael Shaffer are all independent Directors, as defined by our Corporate Governance Guidelines and Section 303A of the NYSE Listed Company Manual.

In addition, the Board also determined that each member of the Audit Committee (Mary Lou Fiala, Timothy Kilpin, Braden Leonard,(Maxine Clark, Robert Dixon, Craig Leavitt and Michael Shaffer) is independentindependent under the heightened Audit Committee independence requirements included in Section 303A of the NYSE Listed Company Manual and the SEC rules. Moreover, each member of the Audit Committee is financially literate, and at least one such member (Michael Shaffer) has accounting or related financial management expertise as required in Section 303A of the NYSE Listed Company Manual. Furthermore, the Board determined that Michael Shaffer qualifies as an “audit committee financial expert” as such term is defined under applicable SEC rules. Finally, each member of the Compensation and Development Committee (Mary Lou Fiala, Timothy Kilpin,(Craig Leavitt, Anne Parducci, Sarah Personette and Coleman Peterson)Michael Shaffer) is independent under the heightened Compensation Committee independence requirements included in Section 303A of the NYSE Listed Company Manual, is a “non-employee director” pursuant to SEC Rule 16b-3 and is an “outside director” for purposes of Section 162(m) (“Code Section 162(m)”) of the Internal Revenue Code of 1986, as amended (the “Code”).

RELATED PARTY TRANSACTIONS

In addition to annually reviewing the independence of our Directors, the Company also maintains strict policies and procedures for ensuring that our Directors, executive officers and employees maintain high ethicalethical standards and avoid conflicts of interest. Our Business Conduct Policy prohibits any direct or indirect conflicts of interest and requires any transactions which may constitute a potential conflict of interest to be reported to the Nominating and Corporate Governance Committee. Our Code of Ethics applicable to Senior Executives requires our leadership to act with honesty and integrity, and to disclose to the Nominating and Corporate Governance Committee any material transaction that reasonably could be expected to give rise to actual or apparent conflicts of interest.

Our Nominating and Corporate Governance Committee has established written procedures for the review and pre-approval of all transactions between us and any related parties, including our Directors,Directors, executive officers, nominees for Director or executive officer, 5%25% stockholders and immediate family members of any of the foregoing. Specifically, pursuant to our Business Conduct Policy and Code of Ethics, any Director or executive officer intending to enter into a transaction with the Company must provide the Nominating and Corporate Governance Committee with all relevant details of the transaction. The transaction will then be evaluated by the Nominating and Corporate Governance Committee to determine if the transaction is in our best interests and whether, in the Committee’s judgment, the terms of such transaction are at least as beneficial to us as the terms we could obtain in a similar transaction with an independent third party. In order to meet these standards, the Nominating and Corporate Governance Committee may conduct a competitive bidding process, secure independent consulting advice, engage in its own fact-finding, or pursue such other investigation and fact-finding initiatives as may be necessary and appropriate in the Committee’s judgment.

Store Fixtures and Furniture

We purchase some of the fixtures for new stores and furniture for our corporate offices from NewSpace, Inc. (“NewSpace”). Robert Fox, the husband of Ms. Clark, a Director and, through June 3, 2013, our Chief Executive Bear, owns 100% of the capital stock of NewSpace. The total payments to NewSpace for these fixtures and furniture amounted to approximately $195,000 in fiscal 2016.

We periodically conduct a competitive bid process for purchase of store fixtures and furniture, with the most recent process conducted in 2015. Taking into account all relevant factors, including price and quality, the Nominating and Corporate Governance Committee determined that engaging NewSpace as a vendor was in the best interests and, the terms of the transactions were at least as beneficial to the Company as the terms it could obtain in a similar transaction with an independent third party. The Nominating and Corporate Governance Committee reviewed the terms of the transactions with NewSpace and determined that they are at least as beneficial to us as the terms we could obtain in similar transactions with an independent third party. We expect to continue to purchase some of our store fixtures and furniture from NewSpace if NewSpace continues to offer competitive pricing and provide superior service levels.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s Directors and executive officers, persons who beneficially own more than 10% of a registered class of the Company’s equity securities, and certain other persons to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC, and to furnish the Company with copies of the forms. Based solely on its review of the forms it received, or written representations from reporting persons, the Company believes that all of its Directors, executive officers and greater than 10% beneficial owners complied with all such filing requirements during 2016.2018.

BOARD OF DIRECTORS COMPENSATION

The table below discloses compensation information of members of the Company’sCompany’s Board of Directors for serving as members of the Company’s Board in 2016.for the fiscal year ended February 2, 2019. As a member of management, Sharon John, the Company’s President and Chief Executive Officer, did not receive compensation for her services as Director in 2016. As discussed below, Mr. Ebsworth was not paid any compensation for serving as Director Emeritus2018. Messrs. Leavitt and Dixon were appointed to the Company’s Board in 2016. 2018.

Fees | ||||||||||||||||

Earned or | Stock | All Other | ||||||||||||||

Paid in | Awards | Compensation | ||||||||||||||

| Name: | Cash($)(1) | ($)(2) | ($) | Total ($) | ||||||||||||

Mary Lou Fiala | $ | 75,000 | $ | 92,558 | $ | - | $ | 167,558 | ||||||||

Michael Shaffer | 68,500 | 77,948 | - | 146,448 | ||||||||||||

Coleman Peterson | 61,250 | 77,948 | - | 139,198 | ||||||||||||

Braden Leonard | 60,000 | 77,948 | - | 137,948 | ||||||||||||

Maxine Clark | 50,000 | 77,948 | - | 127,948 | ||||||||||||

Timothy Kilpin | 42,740 | 94,401 | - | 137,141 | ||||||||||||

Sarah Personette | 42,740 | 94,401 | - | 137,141 | ||||||||||||

James M. Gould (3) | 17,808 | - | - | 17,808 | ||||||||||||

Fees | ||||||||||||||||

Earned or | Stock | All Other | ||||||||||||||

Paid in | Awards | Compensation | ||||||||||||||

| Name: | Cash($)(1) | ($)(2) | ($) | Total ($) | ||||||||||||

Craig Leavitt (3) | $ | 83,283 | $ | 102,917 | $ | - | $ | 186,200 | ||||||||

Robert L. Dixon, Jr. (4) | 57,363 | 105,610 | - | 162,973 | ||||||||||||

Michael Shaffer | 68,500 | 86,668 | - | 155,168 | ||||||||||||

Sarah Personette | 50,000 | 86,668 | - | 136,668 | ||||||||||||

Maxine Clark | 50,000 | 86,668 | - | 136,668 | ||||||||||||

Anne Parducci | 50,000 | 86,668 | - | 136,668 | ||||||||||||

Coleman Peterson (5) | 18,791 | - | - | 18,791 | ||||||||||||

(1) | Amount shown reflects annual Board, committee Chair and Non-Executive Chairman annual cash retainers. See the “Director Compensation Policies” section below for an explanation of the annual cash retainers. |

(2) | In |

(3) | Mr. |

(4) | Mr. Dixon was appointed to the Board of Directors effective February 12, 2018. |

(5) | Mr. Peterson retired from the Board of Directors upon the expiration of his term |

Director Compensation Policies

The Compensation and Development Committee reviews Board compensation annually in conjunction withbased on information provided by the November Board meeting.Committee’s independent compensation consultant Meridian Compensation Partners, LLC (“Meridian”). Currently, the Board compensation program provides for an annual cash retainer for Board membership, an annual restricted stock awardaward and additional annual cash retainers for committee Chairs. The Non-Executive Chairman receives an additional annual cash retainer and restricted stock award for herhis service. Board members do not receive additional fees or compensation for attending meetings or for serving on Board committees.

In connection with its annual review, Meridian reviewed the Compensation and Development Committee noted thatCompany’s independent director compensation had not been increased since 2005 and, based on information provided byprogram compared to the Committee’s independent compensation consultant, that annual compensation had fallen below the medianprograms of the peer group discussed in the “Executive Compensation Summary” section of this proxy statement. Based on Meridian’s conclusion that the Company’s independent director compensation was at approximately the 50th percentile relative to the peer group. Accordingly, effective January 2016, the Board increasedgroup, the annual Board retainerand committee cash retainers and the value of the annual Board restricted stock award, as well as the Non-Executive Chairman’s annual cash retainer and restricted stock award.award, were left unchanged for 2018. These increasesamounts are reflected in the table below.

Compensation Element |

| Amount ($) |

| |

Board Cash Retainer |

| $ | 50,000 |

|

Restricted Stock Award Value(1) |

|

| 80,000 |

|

Audit Committee Chair Cash Retainer |

|

| 18,500 |

|

Compensation and Development Committee Chair Cash Retainer |

|

| 11,250 |

|

Nominating and Corporate Governance Committee Chair Cash Retainer |

|

| 10,000 |

|

Additional Non-Executive Chairman Cash Retainer |

|

| 25,000 |

|

Additional Non-Executive Chairman Restricted Stock Award Value(1) |

|

| 15,000 |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

(1) | The number of shares of restricted stock awarded is determined on the grant date and is prorated in the case of a Director who joins the Board during the year. Grants are made on the date of each annual meeting of stockholders and vest one year later, subject to continued service on the Board. |

Our Corporate Governance Guidelines provide that non-management Directors are required to own shares of the Company’sCompany’s common stock having a value equal to three times the annual cash retainer for Board membership. This policy does not apply to Directors Emeritus.

Under our Corporate Governance Guidelines, no Director may stand for election or re-election after reaching the age of 73. However, a retiring Director may be asked by the Board to continue to serve the Company in the status of Director Emeritus. A Director Emeritus does not receive an annual cash retainer or restricted stock grant.

We reimburse our Directors and Directors Emeritus for reasonable out-of-pocket expenses incurred in connection with attendance and participation in Board and committee meetings. We also reimburse our Directors for expenses incurred in the attendance of directordirector continuing education conferences.

EXECUTIVE COMPENSATION

EXECUTIVE COMPENSATION SUMMARY

COMPENSATION DISCUSSION AND ANALYSIS

The following provides compensation information pursuant to the scaled disclosure rules applicable to “smaller reporting companies” under SEC rules and may contain statements regarding future individual and Company performance targets and goals. These targets and goals are disclosed in the limited context of the Company’s compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply these statements to other contexts.

Overview of Compensation Program

The following Compensation Discussion and Analysis (“CD&A”)section describes our overall compensation philosophy and the primary components of our executive compensation program. Furthermore, the CD&A explains the process by which the Compensation and Development Committee determined the fiscal 2016 compensationprogram for the following Named Executive Officers:Officers (“NEOs”) for fiscal 2018:

Sharon JohnJohn – President and Chief Executive Officer

Voin Todorovic – Chief Financial Officer

Jennifer Kretchmar–Kretchmar– Chief Merchandising Officer

J. Christopher Hurt – Chief Operations Officer

Eric Fencl – Chief Administrative Officer, General Counsel and Secretary

Executive Summary

Summary of Fiscal 2015 and 2016 Financial Results

The Company is in the midst of a multi-year turnaround initiative that includes expanding into more places, developing more products, attracting more people, and driving more profitability. During fiscal 2015, profitability continued to improve even though revenues declined, due in part to fiscal 2015 including only 52 weeks compared to 53 weeks in fiscal 2014. Fiscal 2015 results included:

Total revenues of $377.7 million compared to $392.4 million in fiscal 2014;

Pre-tax income improved to $17.9 million compared to $16.0 million in fiscal 2014; and

Net income was $27.3 million, or $1.59 per diluted share, an improvement from net income of $14.4 million, or $0.81 per diluted share, in fiscal 2014.

After three consecutive years of comparable sales increases and improved profitability, in December 2016 the Company was significantly impacted by a sudden decline in retail traffic, particularly in North America. As a result, revenues and profitability were significantly and adversely impacted. Fiscal 2016 results include:

Total revenues of $364.2 million;

Pre-tax income of $5.3 million; and

Net income of $1.4 million, or $0.09 per diluted share.

2016 Say on Pay Vote

In 2016, we received a favorable advisory vote on our executive compensation program. Over 93% of shares voted at our 2016 Annual Meeting of Stockholders voted to approve our executive compensation program. The Committee believes this affirms our stockholders’ strong support of the Company’s executive compensation program and did not change its approach in 2016 based on the results of the advisory vote. The Committee will continue to monitor and consider the outcomes of future advisory votes on the Company’s executive compensation program when making compensation decisions for the NEOs.

Key 2016 Compensation Decisions

We seek to design and implement executive compensation programs that align with our stockholders’ interests. A significant portion of our NEOs’ compensation is based on individual, corporate financial, and company stock price performance, while avoiding the encouragement of unnecessary or excessive risk-taking. For 2016, our NEOs’ total direct compensation consisted of a mix of base salary, annual cash bonuses based on the achievement of pre-established financial goals, and long-term incentive awards consisting of time-based restricted stock, performance-based restricted stock, and non-qualified stock options.

In March 2016, the Committee approved adjustments to our NEOs’ compensation programs as highlighted below:

Based on the Company’s financial results for 2015, the market data provided by our compensation consultant, and individual considerations, the Committee approved salary increases for NEOs for 2016, ranging from 3.7% to 9.0% of the NEOs’ 2015 salary levels.

The Committee approved the Company’s 2016 bonus plan goals to continue its focus on profitability. For the previous several years, the Company had a tax valuation allowance which resulted in significant fluctuations in its tax rate. In 2015, due to the Company’s recent return to profitability, the Company reversed the valuation allowance on its U.S. deferred tax assets. Because the Company’s tax rate was expected to stabilize in 2016, the Committee changed the profitability metric from consolidated pre-tax income to consolidated net income (“net income”).

For 2016, the Committee approved a grant of annual long-term incentive awards consisting of time-based restricted stock (50% of grant value) and non-qualified stock options (50% of grant value) for NEOs. Our target grant levels were increased from 2015 levels to better align our NEOs’ compensation with peer market levels.

In order to provide additional focus on long-term growth, the Committee elected to increase the length of the performance period of performance-based restricted stock grants to our NEOs from one year to three years. To facilitate this transition, for 2016, the Committee approved a special grant of three-year performance-based restricted stock for NEOs based on cumulative consolidated total revenues for 2016-2018. Awards were sized to be approximately 50% of each NEO’s adjusted 2016 base salary other than Ms. John, who was granted a target award of 85,000 shares.

|

| |

|

|

In addition to the key decisions approved by the Committee for 2016, the Company’s executive compensation program continues to feature the following best practices:

Stock ownership guidelines for executives and Directors;

Incentive compensation recoupment, or “clawback”, provisions on incentive awards;

Insider trading policy, including anti-pledging and anti-hedging provisions for executives and Directors;

No tax gross-up provisions on any compensation or severance events; and

No executive perquisite benefits, beyond Company-paid long-term disability insurance.

Alignment of 2016 Chief Executive Officer Pay and Historical Performance

As discussed throughout this CD&A, the Committee seeks to design executive compensation programs that are highly aligned with long-term shareholder value creation and provide rewards for the achievement of pre-established Company financial metrics. In keeping with this philosophy, the Committee approved a target mix of total direct compensation (base salary, annual bonus, and long-term incentives) for 2016 for our Chief Executive Officer, heavily weighted on performance-based compensation, with approximately 65% of total direct compensation weighted on target annual bonus (18%), special three-year performance-based restricted stock (30%), and non-qualified stock options (17%), and the remainder comprised of salary (18%) and time-based restricted stock (17%).

Based on this emphasis on performance-based compensation, historically our Chief Executive Officer’s compensation has had a strong relationship with our Company performance. As discussed earlier in the “Executive Summary” section, in 2016 the Company generated lower financial results than was targeted in our financial plan, and as a result, our Chief Executive Officer earned less performance-based compensation awards than targeted by the Committee at the grant date. The table below shows our historical pre-tax income (loss) and fiscal year end stock price per share from 2011-2016.

Fiscal Year | Pre-tax Income (Loss) ($ in millions) | Fiscal Year End Stock Price Per Share ($) | ||||||

2011 | $ | (2.7 | ) | $ | 8.46 | |||

2012 | (48.4 | ) | 3.91 | |||||

2013 | (2.1 | ) | 7.74 | |||||

2014 | 16.0 | 19.11 | ||||||

2015 | 17.9 | 12.24 | ||||||

2016 | 5.3 | 13.75 | ||||||

The comparison below of performance-based compensation granted to our Chief Executive Officer to the amount of such compensation that was actually paid or vested based on the Company’s performance demonstrates the alignment of compensation to Company financial performance:

Summary of Chief Executive Officer Annual Bonuses Paid as a Percent of Target

Year(1) |

|

| Target |

|

| Actual Payout |

|

| Actual Payout Percent of Target |

| |||

2011 |

|

| $ | 659,200 |

|

| $ | 0 |

|

|

| 0 | % |

2012 |

|

|

| 824,000 |

|

|

| 0 |

|

|

| 0 | % |

2013(2) |

|

|

| 336,538 |

|

|

| 286,058 |

|

|

| 85 | % |

2014 |

|

|

| 656,250 |

|

|

| 958,125 |

|

|

| 146 | % |

2015(3) |

|

|

| 665,625 |

|

|

| 465,938 |

|

|

| 70 | % |

2016 |

|

|

| 694,231 |

|

|

| 0 |

|

|

| 0 | % |

|

|

|

|

|

|

Summary of Performance-Based Restricted Shares/Long-Term Cash Earned as a Percent of Target

Year(1) |

|

| Target Shares |

|

| Target Cash |

|

| Shares Vested from Performance |

|

| Cash Earned from Performance |

|

| Actual Shares/Cash Earned as a Percent of Target |

| |||||

2011 |

|

|

| 27,416 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 0 | % |

2012 |

|

|

| 58,220 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 0 | % |

2013(2) |

|

|

| — |

|

| $ | 468,700 |

|

|

| — |

|

| $ | 398,395 |

|

|

| 85 | % |

2014 |

|

|

| — |

|

|

| 144,375 |

|

|

| — |

|

|

| 210,788 |

|

|

| 146 | % |

2015 |

|

|

| 11,178 |

|

|

| — |

|

|

| 6,930 |

|

|

| — |

|

|

| 62 | % |

2016 |

|

|

| —(3) |

|

| — |

|

|

| — |

|

| — |

|

|

| — | |||

|

|

|

|

|

|

Compensation Philosophy

The fundamental objectives of our executive compensation program are to attract and retain highly qualified executive officers, to motivate these executive officers to materially contribute to our long-term business success, and to align the interests of our executive officers and stockholders by rewarding our executives for individual and corporate performance based on targets established by the Committee.

We believe that achievement of these compensation program objectives enhances long-term stockholder value. When designing compensation packages to reflect thesethese objectives, the Committee is guided by the following four principles:

• | Alignment with stockholder interests: Compensation should be tied, in part, to our stock performance through the granting of equity awards to align the interests of executive officers with those of our stockholders. | |

• | Recognition for business performance: Compensation should correlate in large part with our overall financial results so that the Company pays for performance. | |

• | Accountability for individual performance: Compensation should partially depend on the individual executive’s performance, in order to motivate and acknowledge the key contributors to our success. | |

• | Competition: Compensation should generally reflect the competitive marketplace and be consistent with that of other well-managed companies in our peer group and the broader retail industry sector. |

In implementing this compensation philosophy, the Committee takes into account the compensation amounts from the previous years for each of the NEOs, and internal compensation equity among the NEOs. Historically, the Committee has strived to structure compensationcompensation packages so that total payout, taking into consideration performance-based compensation, will be near the median of the Company’s peer group if the Company meets its financial targets and above the median if the Company exceeds its financial targets and the individual NEOs perform well in their roles throughout the fiscal year. Over the past several years, however, immediately prior to and during the early stages of our turnaround efforts, NEO compensation packages have fallen below the median.

20162018 Compensation Determination Process

Each year the Committee engages in a review of our executive compensation with the goal of ensuring the appropriate combination of fixed and variable compensation linked to individual and corporate performance.

Role of the Committee and Board of Directors